Beowolff Capital Acquires Artnet: What It Means for the Future of the Art Market

By Nina Orm, Founder & General Partner of The Agora Fund

In a move that's shaking the foundations of the art world, UK-based private equity firm Beowolff Capital has acquired a controlling stake in Artnet, one of the industry's leading digital platforms for art market data and auctions. With a deal valued at approximately $73.7 million (€65 million), including a 97% premium on Artnet's share price, this acquisition signals a new era of consolidation, innovation, and perhaps contention in the evolving art economy.

The acquisition comes on the heels of Beowolff’s majority ownership in Artsy, making this a strategic play to dominate the digital art infrastructure—uniting primary and secondary market data, technology, and community under one roof. But what exactly does this mean for the art world, and why does it matter?

Let’s break it down.

What Happened: The Deal Structure

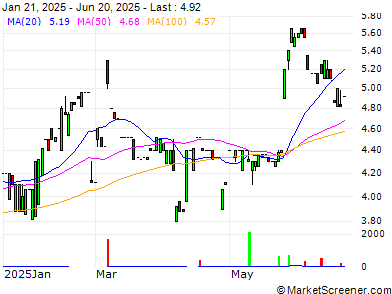

Beowolff Capital now owns 65% of Artnet, purchasing shares from both the open market and major shareholders, including a 29.99% stake from Weng Fine Art AG. The purchase price was set at $12.95 (€11.25) per share, offering a significant premium and making the deal nearly irresistible to investors.

This acquisition takes Artnet private, removing it from the Frankfurt Stock Exchange and freeing it from the financial and regulatory constraints of quarterly earnings and shareholder appeasement. In short: Beowolff is betting big on a long-term digital transformation—and they want room to build without interruption.

Why Beowolff Acquired Artnet

1. Market Consolidation & Vertical Integration

By owning both Artsy (a leading primary-market platform) and Artnet (a pioneer in auction results, market data, and editorial), Beowolff is positioning itself to control the entire value chain of digital art commerce. This allows for integration between galleries, collectors, and auction houses—all connected through shared data, pricing tools, and predictive insights.

2. Data and AI Are the New Canvas

Artnet's robust dataset—spanning decades of auctions—is a goldmine for AI-powered pricing models and market analysis tools. By combining this with Artsy’s real-time primary market sales, Beowolff is uniquely positioned to develop tools that can forecast demand, optimize pricing, and transform how art is bought and sold online.

3. Escaping Public Market Pressures

Taking Artnet private allows for leaner operations, faster product development, and more agile decision-making. With no shareholders to appease, Beowolff can focus entirely on building next-generation tech and business models without the short-term demands of public markets.

4. A Strategic Financial Rescue

For Artnet, the deal was likely a lifeline. Weng Fine Art had faced financial strain, and Artnet itself was nearing insolvency. Beowolff’s capital infusion provided immediate liquidity and stability while offering Weng an exit strategy.

What It Could Mean for the Art Market

This acquisition isn’t just a financial maneuver—it’s a harbinger of a larger shift in the cultural economy. Here’s what to expect:

Increased Intelligence, If Access Remains

With deeper integration of pricing data, we could see better tools for valuation, discovery, and pricing transparency. This might democratize collecting—if the tools remain accessible to all.

Data Gatekeeping and Platform Power

There’s growing concern that core market data will move behind paywalls. If Beowolff uses these assets to create walled gardens, it could reduce access for smaller players and further concentrate market power among elite collectors and institutions.

Editorial Independence in Question

Artnet News has long been a respected source of art journalism. Will its coverage remain impartial under Beowolff’s ownership? Or will it evolve into content that supports its parent company's business agenda?

Art as Asset Class, Rebranded

This deal may also accelerate the legitimization of art as a mainstream investment class. With improved pricing tools, clearer market visibility, and AI-driven forecasts, more institutional investors may enter the art space—further financializing culture.

My Take: What I Think This Signals

At Creativity Meets Capital, I believe this acquisition represents a crossroads:

A new infrastructure is being built. One that could empower artists and collectors through better data and transparency—but only if access remains inclusive.

This is also a consolidation of influence. If a single firm controls the tools, platforms, and data, we risk trading elitism in the gallery system for elitism in the algorithm.

There’s massive potential to rethink pricing and equity in the art market. AI tools, if designed well, could help level the playing field by illuminating overlooked artists and undervalued works. But without intentional oversight, they could simply reinforce existing biases.

What to Watch For Next

Integration plans between Artsy and Artnet: Will the platforms merge, or remain distinct?

Product launches: New AI features? Analytics dashboards? Paid data tiers?

Editorial evolution: Will Artnet News maintain its reputation for critical, independent reporting?

Market response: Will other players (like Sotheby’s or newer platforms like Artlogic or Fairchain) adapt, consolidate, or compete?

Final Thoughts

This deal marks a turning point. We’re witnessing the financialization and technologization of the art world accelerate—and this is your reminder: creators and culture workers must have a seat at the table while the new infrastructure is being built.

Beowolff Capital is placing its bets. So should we.

Let’s keep our eyes open—and our business models smart.

💡 Nina Orm

🎨 Cultural Investor | Founder, The Agora Fund & Orm Muse Collective

📩 Subscribe for more: Creativity Meets Capital