From Patrons to Investors: The Evolution of Creative Funding

How today’s cultural capital mirrors the Medici legacy in a new financial age | By The Agora Fund

A Different Kind of Dynasty

History remembers the Medici not for their balance sheets, but for the legacy they bankrolled.

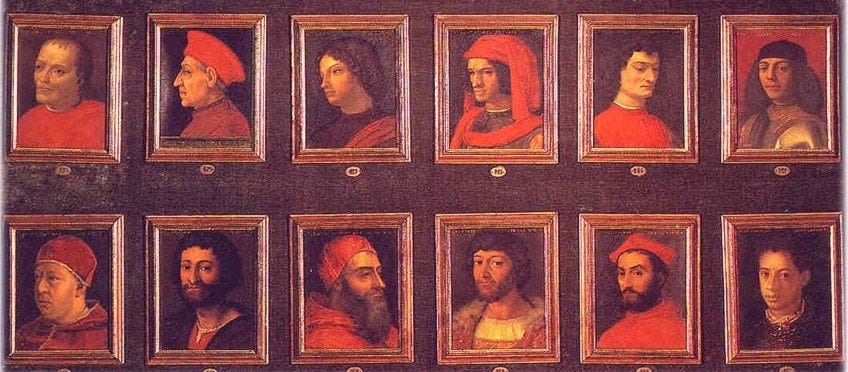

They were more than financiers. They were architects of beauty. Quietly, strategically, they reshaped human history through creative investment. They backed Botticelli, Leonardo da Vinci, Michelangelo. And in doing so, they didn’t just fund art—they funded identity. The Renaissance wasn’t a moment. It was a model.

One where capital, culture, and curiosity collided.

Now, in 2025, we find ourselves on the edge of a new creative era. The creators are here. The ideas are ripe. The cultural energy is unmistakable.

But the capital?

Still catching up.

At The Agora Fund, we believe the modern equivalent of Renaissance patronage isn’t philanthropy—it’s venture capital. And the next Medicis aren’t hiding behind castles. They’re emerging as cultural investors, reshaping the world through intentional finance.

Patronage Wasn’t a Hobby—It Was Strategy

Let’s be clear: the Medici weren’t just throwing coins at painters for fun.

They had vision.

They understood that culture legitimizes power. That beauty is not a luxury—it is infrastructure. That funding the arts was an investment in their city, their influence, and their immortality.

They saw that:

Art shapes politics.

Design shapes legacy.

Ideas shape the future.

So they put their money where the muse lived. Not as an act of charity, but as a means of future-proofing power.

Modern investors should take notes.

Creatives Don’t Need Patrons—They Need Partners

Today’s creatives aren’t waiting in church pews hoping for the next wealthy benefactor. They are designers with scalable brands, filmmakers with global reach, visual artists turning their IP into multimedia empires.

But even now, they face outdated funding structures that don’t understand their worth:

Venture capital asks for tech-style scalability.

Banks ask for collateral in industries built on ideas.

Philanthropy wants output without ownership.

So the creative economy floats in a liminal space: too risky for Wall Street, too radical for traditional grants.

But here’s the truth:

Today’s creatives are not charity cases. They are investment-grade.

At The Agora Fund, we treat them as such.

The Medici Model, Reimagined

We’re not interested in nostalgia—we’re interested in lineage.

The Medicis backed artists who didn’t just decorate walls. They redefined what it meant to be human. They created aesthetic capital that moved nations.

We believe modern creators do the same.

A few examples:

A fashion label that rewrites the visual narrative of Black womanhood is cultural infrastructure.

A film that reframes immigrant joy is political commentary.

A digital art archive preserving endangered languages is technological resistance.

These are not soft assets.

They are essential ones.

And we back them not with pity, but with strategy.

What Cultural Investors Understand That Others Miss

Cultural investors are a new archetype in finance. They are not trend-chasers. They are taste-makers, memory-builders, movement-funders.

They know:

Art outlasts algorithms.

Design outperforms data in staying power.

Culture compounds.

These investors are looking for something different:

🟣 They want resonance, not just return.

🟣 They want influence that echoes.

🟣 They want to fund what they wish to live in.

And frankly?

That’s the future of capital.

The Agora Fund: Replacing the Gallery Wall with the Cap Table

At The Agora Fund, we modernize the model of patronage by building capital vehicles designed for cultural output.

We:

Fund cultural IP at seed stage: not when it’s trending, but when it’s visionary.

Structure deals to respect creative autonomy while offering business scale.

Reimagine exit strategies to include licensing, franchising, and collective ownership.

Support projects that don't just monetize, but immortalize.

We're not here to save artists.

We're here to strategically partner with them—because they are the architects of the future.

This Is Legacy Work

You may not be building a cathedral, but you might be backing the next Kehinde Wiley, Ava DuVernay, or Simone Leigh.

And while others are chasing the next billion-dollar exit, you could be underwriting the next century’s cultural canon.

That’s not just legacy.

That’s renaissance logic.

So to our fellow investors:

Step out of the numbers and into the narrative.

Ask yourself:

What are you funding that future generations will thank you for?

If the answer is nothing yet—let’s change that.

From Florence to the Feed—Renaissance Never Died, It Just Got Digitized

The tools have changed.

The timelines have shortened.

But the fundamentals remain:

Invest in artists → Shape society.

Invest in beauty → Shape belief.

Invest in stories → Shape the soul of civilization.

The Medici didn’t wait for permission.

Neither do we.

Welcome to the Agora Renaissance.

—

Written by The Agora Fund’s Founding Partner: Nina Orm

Originally published on The Agora Fund’s blog ‘The Agora Journal’ on July 6, 2025.